Investment is the creation of tools to amplify human ability and thereby enhance future prosperity. The process of investment involves two steps. The first step is the diversion of current prosperity producing efforts toward the creation of facilities or equipment which we expect to be useful in producing tomorrow's prosperity. The second step is the actual utilization of the new facilities and equipment to enhance future prosperity. An investment is considered to be prosperity enhancing or profitable if the cost in present wealth is less than the increase in time discounted future wealth over the service life of the investment. Reaping the benefits of past investments is the easy part of investment. The hard part of investing is making the decision to invest current wealth and in so doing lose its contribution to current prosperity. Failure to adequately invest as America is now doing seriously diminishes America's potential for future prosperity.

Tools can be considered to be another class of living power structures. Tools are arrangements of matter created by living cells to enhance prosperity. Humanity's tools are really physical extensions of the human body that amplify our capabilities. The tusk of an elephant and the spear of a human both extend the capabilities of their respective living power structures. However unlike the elephant, we can have a whole work bench of different tools each specialized for a particular use. While all our tools are presently inanimate, many are quite active and some can operate for considerable periods producing useful work without any human intervention.

The unique characteristic of tools is their complete obedience without any additional motivation or rewards.. Mankind initially domesticated animals to enhance his prosperity both through animals' enhanced abilities (service) and by undercompensation for their efforts (predation). However all but the least intelligent animals required motivation which reduced their net output. Human slaves suffered from the same motivational requirements which led to the invention of more sophisticated forms of feudalism. Tools however make perfect slaves. Tools do what they are told without seeking a free market return for the value they add to the production process. Tools are such a powerful prosperity enhancing mechanism, because humanity can claim both the productive output due to human effort and the productive output due to the tools less any maintenance/depreciation requirements.

The current prosperity of mankind is largely due to the uncompensated productive effort of our tools. This book was created through a combination of my effort and the incredible support of my Macintosh computer. Without the enhanced efficiency of computer word processing, writing this book would have been considerably more time consuming. Yet my computer has never asked for any share of the royalties and it is perfectly content to support me for a few kilowatts of electricity. The dramatic on-going revolution in workplace productivity due to the personal computer is only one example of the many ways in which human prosperity is supported by the undercompensation of technical servants we depend on to run our modern world. The dramatic advance of civilization over the last few hundred years was primarily driven by advances in the number and ability of our tools. Likewise our hopes for enhanced future prosperity will be largely determined by the level of our technology as measured both by the number of our tools (investment) and by their increased productive ability (technical innovation).

From the dawn of civilization up to the industrial revolution, tools were universally viewed as beneficial to mankind. Since the ownership of tools was widespread throughout the population, so was the control over the tools use and the distribution of the tool's productive efforts. Investment decisions such as should I build or buy a new plow were individual free market decisions. Territorial feudalism enabled the feudal lord to steal the peasant's harvest, but the peasants still controlled the use of their simple tools. Technical innovations dramatically advanced the ability of tools to perform productive effort. This led to the industrial revolution characterized by a rapid increase in the number and sophistication of mankind's tools.

The growth of industrial feudalism began the politicization of investment decisions. Territorial feudalism only required a mechanism of legalized theft to control the finite supply of land. However unlike land, there is no inherent limit to the number of tools. Therefore the past and present existence of industrial feudalism requires mechanisms of legalized theft to control capital investment in the production and utilization of tools. The birth of industrial feudalism was orchestrated by a class of tool owners (industrialists) who controlled both the ownership and use of society's tools. Control of society's tools gave the industrial feudal lords both the total return of the productive output of the tools and a greater than free market return on the productive output of the workers which they allowed to use the tools. This system of feudal theft led to the union movement to obtain higher compensation for workers' productive efforts. The compensation received was not based on contributed value, but simply on the relative political power of the unions and the industrialists. In many cases the political power of the unions led to investment disincentives both directly due to overcompensation for worker's efforts and indirectly through tax policy that discouraged investment.

America has become a low investment - high consumption society. America's savings rate is among the lowest of the major industrialized nations and our government's deficits further reduce capital available for productive investments. As a result our infrastructure is falling into disrepair and our industries are in many cases either underequipped or using obsolete equipment. This situation is seriously limiting America's prosperity today and if not reversed will even more seriously limit our future prosperity. America's low savings rate is primarily a reflection of the incentives for consumption and the lack of competing rewards for investment. The easy availability of credit encourages consumption and the double taxation of dividends and the capital gains taxation of inflationary gains are examples of two rules that discourage savings and investment.

Investment has become a class issue in American society. While the many instances of legalized theft in our society unfairly distort the income distribution in America, the highly skewed distribution of wealth is largely due to the unwillingness of most of the American people to save. The small percentage of Americans who do save end up owning most of our country's wealth. America's distorted wealth distribution both creates a power structure that facilitates legalized theft and makes most Americans envious of the wealthy few even when they are not stealing. Since America's prosperity depends on increased investment, we must democratize the distribution of wealth by promoting savings to significantly broaden the American people's sense of ownership in their country.

Efforts to increase America's savings rate first require a better understanding of the factors that motivate people to save. I believe that there are at least four such motives namely: 1) rainy day security 2) middle age prosperity 3) old age or retirement income and 4) financial security for one's children.

Ironically one of the primary causes of America's low savings rate is the success of our social institutions in creating a sense of security. Historically rainy day (or disaster) security was one of the primary motives for savings. Life was full of short term problems ranging from illness to poor harvests. The daily experience of seeing the suffering of friends and neighbors who had not adequately saved to cover some emergency was a constant reminder of the need for rainy day savings. The periodic occurrence of war, depression or natural disasters left whole generations traumatized into being confirmed savers. Scarlett's famous line in Gone With The Wind, " I'll never be hungry again.", dramatically portrays the effects of disasters on people's savings habits.

The marvelous social innovation of insurance provides people with protection from many rainy day risks. Insurance substitutes the certainty of a small loss (the premium) for the uncertainly of a large loss. True disaster insurance (e.g. fire, flood, earthquake etc.) promotes security without affecting savings since most people would never save enough to cover such catastrophic losses. However the pervasive use of insurance in America to cover events that are almost routine removes the need for each person to accumulate excess savings to independently cover such events.

Government social programs have carried the effects of insurance a step further. While insurance reduced the need for excess savings by pooling risks, insurance at least accumulated funds to cover losses before they occurred. Insurance companies accumulated reserves that were a source of investment capital. However most government programs eliminate saving for emergencies by paying for disasters out of current taxes or by borrowing. With insurance the individual was responsible for his own welfare which fostered self reliance and encouraged a rainy day savings mentality. With government programs, someone else does the disaster planning. The resulting cradle to grave security while socially desirable unfortunately discourages citizens from rainy day savings.

The savings motive to provide for middle age prosperity is not I believe uniformly distributed throughout humanity. While separating this motive from the others is difficult, there is a clear intellectual distinction. Each individual has a different time value of money which may change with his age or circumstances. The prevailing interest rate in society is the weighted average of everyone's time value of money. If an individual is future oriented, then his time value of money will be less than the prevailing interest rate. Such individuals are motivated to consume less today and invest the rest at what to them seems like an attractive interest rate. Conversely individuals who are strongly present oriented have a time value of money that exceeds the prevailing interest rate. These individuals are motivated to spend all they earn and even borrow against future income. We should be reluctant to place moral judgments on individuals' differing sense of the time value of money. While there is a moral responsibility to save for periods of hardship (either the unexpected hardships of middle age or the expected hardship of old age), there is no moral criteria to judge how an individual should distribute his available spending over his lifetime. However the absence of moral judgment does not mean the absence of economic consequences.

The removal of rainy day saving through social innovations that promote security and thereby discourage saving is resulting in a more skewed distribution of wealth in America. This skewed distribution of wealth is leading to class distinctions based not on income differences but on wealth differences due to the accumulated savings difference between high and low interest rate people. Unfortunately the power bestowed by wealth presents an irresistible temptation for the wealthy to bias society's rules to steal from the rest of society (right wing theft). Similarly the envy and legitimate anger of the rest of society tempts them to bias society's rules to steal the accumulated wealth of the savers (left wing theft).

The total material wealth of America is simply the accumulated savings of the past and present members of our society. While the technical innovations that support this wealth are timeless, the actual material goods all depreciate in value due to wear and obsolescence. As a Boy Scout I used to hike along the C&O canal north of Washington, D.C. While the locks still work after 150 years, the canal today only contributes recreational value and a sense of history to our national prosperity. The advance of American prosperity driven by technical innovations in transportation in the form of railroads, motor highways and now air transportation have completely depreciated the investment value of the C&O canal. The technical innovations that describe these modern transportation systems made them possible, but only the savings of Americans made them happen. American prosperity depends on policies that encourage savings. America's growing national debt which is being acquired not to fight a war to preserve our freedom or to make capital investment, but simply to feed current consumption is an example of negative savings that must be stopped to preserve the future prosperity of America.

4.7 RECOMMENDATION: RATIFY A BALANCED BUDGET AMENDMENT - Recent history has conclusively shown that our government is unable to resist special interest pressures to steal from future generations through non-investment deficit spending. I have joined the growing ranks of individuals who have concluded that a balanced budget amendment is the only way to stop this process.

Retirement income generates by far the biggest requirement for savings. While rainy day uncertainties may be more compelling, the magnitude of savings required to support retirement income far exceeds any rainy day situation. Because retirement income needs are uncertain, oversaving for retirement results in inherited wealth for future generations. For these two reasons, the magnitude of savings required for retirement and the significant potential for inherited wealth, retirement savings represent America's best opportunity for accumulating investment wealth needed for our national prosperity.

The Social Security Program was a social innovation directed at providing a measure of retirement income security. The original program was intended to provide a small guaranteed retirement income based on a mandatory savings plan financed through payroll deductions. The original program was based on a trust fund that: 1) would be a source of national wealth accumulation and 2) could only pay retirees an amount based on a free market return on their contributions. However temptations for theft led to violating the trust fund with severe consequences for American prosperity.

The rape of the social security system was likely one of the largest instances of legalized theft in American history. This rape of social security is allowing about two generations of retirees to receive benefits that are completely out of line with a free market return on their contributions. The size of their payment is simply a reflection of their political power and the use of that power to commit left wing theft. When given the choice between remaining with Social Security (with the implied promise that America's children would support them in their old age) and leaving the system (and taking their contributions and their "employer's contribution" with them) most workers would opt for the latter. The survival of the current system (which taxes many workers more than their federal income taxes) is a testament to both Americans sincere compassion for their parents generation's well being and the awesome political clout of senior citizens where for many the size of their social security check is their only political issue.

The Social Security program is a disaster for American investment and the future prosperity of our country. Like the national debt, the social security program saddles tomorrow's workers without their consent with the burden of supporting their parents' generation in retirement. The existence of the social security program discourages today's income producers from saving for their retirement and the burden of social security transfer payments makes any additional savings extremely difficult. Since the social security burden falls hardest on lower and middle income groups, these groups become non-participants in the wealth creation process. This leaves the already wealthy and the committed savers owning a progressively larger share of the "smaller than it should be" pie of America's wealth. Getting out of the Social Security mess and returning America's retirement savings to a trust fund basis is an essential objective for American investment and future American prosperity.

We need to institute by democratic consensus a Mandatory (individual) Asset Accumulation Program (MAAP). Such a program would accomplish several very important objectives. First MAAP would require each American to accumulate sufficient wealth to provide adequate income for their retirement years. However MAAP would also enhance American prosperity by: 1) enhancing the savings rate and thereby promoting the accumulation of national wealth and 2) significantly democratizing the distribution of wealth in America and thereby promoting political support for pro-investment policies. There is of course no easy way out of Social Security. We have lost a generation of wealth accumulation due to the rape of the Social Security system. The millions of retirees on Social Security must be provided for while we return to a system based on individual accumulated assets.

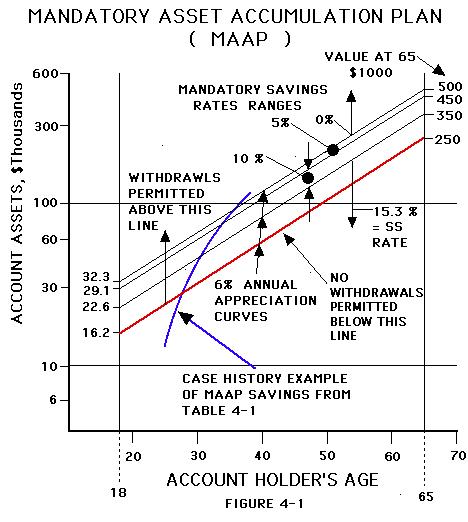

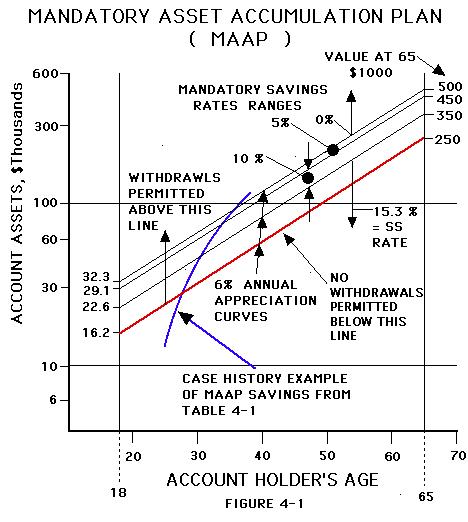

4.8 RECOMMENDATION: INSTITUTE A MANDATORY (INDIVIDUAL) ASSET ACCUMULATION PROGRAM (MAAP) - In broad terms a MAAP would use payroll deductions supported by a schedule SE type form to deposit funds into individually managed retirement/savings accounts. The following paragraphs present a candidate program in more detail to better illustrate some of the features. The typical MAAP program shown in figure 4-1 is based on a real return of 6% after taxes and inflation. All four curves on this figure represent appreciation curves at 6% real return. The bottom or minimum curve reaches a value of $250,000 at age 65. At 6% this would provide an income of $15,000 per year without drawing on principal. The upper three curves reach principal values of $350K, $450K and $500K at age 65 which provide incomes of $21K, $27K and $30K. The four curves correspond to different levels of mandatory savings of 15.3% (current social security rate), 10%, 5% and 0%.

The mechanics of MAAP administration would be through private financial institutions much like IRAs. At the end of January each taxpayer would receive both a statement of the net worth of his MAAP account and his W-2 showing both his wages and his income withholding that had been deposited in his MAAP account (initially 15.3% of his salary). Once the value of accumulated MAAP assets exceeded the minimum curve, the MAAP statement would start showing a accessible balance. This balance could be left in the MAAP account or withdrawn at the individual's discretion without any tax consequences. Individuals who left all or part of their balance intact would see their MAAP assets increase up to the second curve. When MAAP assets exceeded the second (or 10%) curve, the MAAP administrator would inform the customer's employer to only withhold 10% of salary for MAAP contributions. When the MAAP assets exceeded the third curve, withholding would drop to 5% and finally when the assets exceeded the top curve, no withholding would be required. If the assets fell below one of the asset accumulation curves either due to poor investment return or use of the assets, the appropriate withholding rate would be reinstated.

The mechanics of MAAP administration would be through private financial institutions much like IRAs. At the end of January each taxpayer would receive both a statement of the net worth of his MAAP account and his W-2 showing both his wages and his income withholding that had been deposited in his MAAP account (initially 15.3% of his salary). Once the value of accumulated MAAP assets exceeded the minimum curve, the MAAP statement would start showing a accessible balance. This balance could be left in the MAAP account or withdrawn at the individual's discretion without any tax consequences. Individuals who left all or part of their balance intact would see their MAAP assets increase up to the second curve. When MAAP assets exceeded the second (or 10%) curve, the MAAP administrator would inform the customer's employer to only withhold 10% of salary for MAAP contributions. When the MAAP assets exceeded the third curve, withholding would drop to 5% and finally when the assets exceeded the top curve, no withholding would be required. If the assets fell below one of the asset accumulation curves either due to poor investment return or use of the assets, the appropriate withholding rate would be reinstated.

The following example shows the power of wealth accumulation at the 15.3% rate currently withheld for social security. This example is presented in table 4-1 below, and the MAAP assets are shown by the blue example line on figure 4-1. In this example an individual starts working at age 22 at $25,000 per year and begins contributing to his MAAP at 15.3% per year. His salary increases by $1,500 per year up to $35,000 at age 30. By age 27 ( after only 6 years on the program) his assets exceed the minimum curve and start creating an accessible balance. If he does not withdraw his accessible balance, in only three more years at age 30 his assets exceed the second curve and his mandatory saving rate drops to 10%. During the first nine years his annual contributions at 15.3% (current social security rate) range from $3,825 to $5,325 . His account balance at the end of nine years is $51,894 and the accessible balance is $17,416.

CASE HISTORY EXAMPLE OF MAAP SAVINGS

AGE SALARY SAVINGS INTEREST TOTAL ACCESSIBLE

SAVINGS BALANCE

22 25,000 3,825 $3,825

23 26,250 4,016 230 $8,071

24 27,250 4,208 484 $12,762

25 28,750 4,399 766 $17,926

26 30,000 4,590 1,076 $23,526

27 31,250 4,781 1,415 $29,789 $840

AFTER ONLY 6 YEARS, SAVINGS EXCEED MINIMUM CURVE

AND START CREATING AN ACCESSIBLE BALANCE

28 32,500 4,973 1,787 $36,549 $5,864

29 33,750 5,164 2,193 $43,905 $11,379

30 35,000 5,325 2,634 $51,894 $17,416

AFTER 3 MORE YEARS, SAVING BALANCE EXCEEDS SECOND CURVE

AND MANDATORY SAVINGS RATE DROPS TO 10%

31 36,000 3,600 3,114 $58,608 $22,061

32 37,000 3,700 3,516 $65,824 $27,085

33 38,000 3,800 3,949 $73,574 $32,510

34 39,000 3,900 4,414 $81,888 $38,360

AFTER ONLY 4 MORE YEARS, SAVINGS BALANCE EXCEEDS THIRD

CURVE AND MANDATORY SAVINGS RATE DROPS TO 5%

35 40,000 2,000 4,913 $ 88,802 $42,662

36 41,000 2,050 5,324 $ 96,180 $47,273

37 42,000 2,100 5,771 $104,051 $52,209

AT AGE 37, AFTER ONLY 16 YEARS ON THE PROGRAM, THE SAVINGS

BALANCE EXCEEDS THE FOURTH CURVE. AS LONG AS THE SAVINGS

GROW AT 6%, NO FURTHER CONTRIBUTIONS ARE REQUIRED AND THE

BALANCE AT AGE 65 WILL EQUAL OR EXCEED $500,000.

TABLE 4.3-1

Although the mandatory savings rate drops to 10% after age 30, the combination of savings plus interest continue to rapidly build assets. After four more years at age 34, MAAP assets reach $81,888. This amount exceeds the third curve and permits savings to be reduced to only 5%. Even at 5% at age 37 (after 16 years on the program) MAAP assets reach $104,051 and mandatory saving ceases. At 6% net return this amount will reach $500K at age 65 and provide an annual income of $30K per year.

The continued ascent of man (driven by technical innovation and investment in tools that use new technology) makes the democratization of wealth through savings (such as MAAP) absolutely essential. The increasing ability of mankind's tools is unleashing a new social challenge. The term "automation" and the human concern it expresses arose when machines began to acquire the ability to perform highly skilled tasks with little or no human assistance. Prior to automation the machine owners needed human labor to run the machines. The social threat of automation is that the machine owners can now create wealth with technical "servants" without the participation of large segments of society. Clearly education is becoming more essential in the race to keep human worker's in the production loop by increasing human ability. However this is a race we are bound to loose as our tools become increasingly more sophisticated.

As our national income increases, a progressively larger share will be due to the productive efforts of our technical servants. Therefore individual prosperity in the modern world will require both human ability (to produce wealth directly ) and personal investment (to claim a share of the wealth produced by society's machines). A MAAP is needed to democratize the distribution of America's wealth. Without such democratization of wealth, income will also become hopelessly skewed and America will be polarized into a have/have not society. The inevitable political struggles between the right wing theft of those who own society's tools and the left wing theft of those who do not will derail America's ascent toward an enlightened society based on freedom.

Conclusion of Section 4.3 Investment

4.4 Innovation

Innovation is the only path to long term future prosperity because innovation is forever. As discussed in chapter 1.1, education only lasts for the lifetime of an individual. Therefore each generation must relearn the applicable skills of their parents. Investment may last longer, but it also depreciates and must be replaced. However innovation is permanent because knowledge does not depreciate. The remarkable ascent of man has been driven by a multitude of social and recently technical innovations that have dramatically enhanced humanity's ability to work smarter and thereby to prosper. Social innovations were the key factor in mankind's early development and social innovations continue to play a vital role in future prosperity. All the recommendations in this book (including the ones in this chapter) are social innovations directed at enhancing American prosperity by improving the efficiency of our human interactions. While acknowledging the importance of social innovation, the rest of this chapter is specifically directed at technical innovation.

The diversity of American society and the individualism of American culture make technical innovation the strongest tire to carry us to the prosperity of an American Renaissance. Unfortunately American industry seems to be loosing the innovative spirit that was such an important factor in the ascendancy of American technology during the last 100 years. The last half of the 1800's and the first half of this century saw a steady stream of American inventions. The creative genius of men like Edison and the Wright brothers revolutionized technology and enabled America to become the industrial leader of the world. These men and their ideas founded great industrial empires. However the subsequent ownership by industrial empires and by the U.S. government of these ideas and all future inventions of the engineers they employ has resulted in the feudalization of American technology.

The awesome power of technical innovation to enhance human ability is a threat to the prosperity of existing political power structures. Technical innovations can threaten investment in plant and equipment with obsolescence. Innovations can require different educational backgrounds and job skills that can threaten the careers of current workers. Finally technical innovations can torpedo existing free market control mechanisms based on proprietary methods or other feudal controls. The creation of the light bulb is an excellent example of this process. Thomas Edison's invention ushered in a new era of prosperity for mankind and simultaneously caused the extinction of the whale oil lamp industry. Machiavelli understood these human concerns over innovation when he wrote the following admonition to would be innovators.

"It must be remembered that there is nothing more difficult to plan, more doubtful of success, nor more dangerous to manage than the creation of a new system. For the initiator has the enmity of all who would profit by the preservation of the old institution and merely lukewarm defenders in those who would gain by the new ones. "

Machiavelli "The Prince" (1513)

Machiavelli would be quite at home in the 20th century. The nature of man hasn't changed in the last 400 years nor in the last 4000 years. The difference is not in human nature, but in the degree of freedom provided by the political systems people live under.

One of the most important tasks of an enlightened society is to promote innovation and protect innovators from the power of entrenched systems which will try to stifle their innovations before the free market has a chance to properly evaluate them. Technical innovation is a more fragile commodity than social innovation. We are all socially educated and able to formulate alternate approaches to social issues. However technical innovation requires both creativity and sufficient technical training to understand the physical relationships involved before one has a chance at formulating innovative approaches. Therefore only technically trained individuals in a society are able to contribute technical innovations and these fewer individuals are easier to control.

America was one of the first nations to formulate patent laws to encourage technical innovation. This favorable treatment of technical innovators was an important contributing factor to the flood of innovations that help propel American prosperity. However like so many good intentions in our society, intellectual property laws have been subverted to promote the prosperity of American corporations rather than American society. Company ownership of employee patent rights is a nearly universal condition of employment. This absolute control which allows companies to suppress any divergent technologies that emerge has the terrible consequence of thoroughly discouraging technical creativity. One company I know goes so far as to require that each engineer submit at least one patent application a year in a desperate attempt to coerce creativity without the promise of any significant reward for creative effort.

The corporate ownership of employee patent rights is compounded by a dearth of opportunities for engineering self employment. Freedom for engineering professionals strikes at the heart of the feudal control of American technology. Independent engineers would be able to apply some of their time toward inventing and developing new technologies in their field of expertise. These new technologies could threaten the market position of existing companies. The existence of an independent engineering employment option would also threaten corporate power structures by introducing more competition into engineering employment practices and benefits. Not surprisingly the latest tax law revisions specifically tightened up on the requirements for self-employment of consulting engineers and computer specialists. The congressional intent to reinforce feudal control of American technology by large corporate and government agencies by stopping the hemorrhage of technical professionals to independent employment is painfully obvious.

The efforts of large corporate power structures to control technology in their areas of business goes beyond control of their employees to efforts to capture and suppress competing technology. Whereas Japanese companies often license new technology, American and European companies traditionally do not. A successful license gives a small company funds to continue innovating in the area of the license and also encourages other innovators to explore improvements in that area of technology. If companies do anything, they usually buy patents giving them complete control over the technology and its future development. Sometimes they do this to develop a new technology, but often they purchase a patent merely to suppress the technology if they feel it threatens their current business approach. Companies also hire experts in competing technology and fund their research for a sufficient period of time to establish control of the technology. If they then decide to suppress that technology, they offer the expert another position knowing that he can no longer independently pursue his invention.

The pervasive control of advanced technology by the federal government has suppressed innovation in the very areas that could propel America to technical leadership in the 21st century. There is no better example of this process than the record of America's space program. Americans should be proud of the continuing accomplishments of the brave men and women who are leading our space program. However on an absolute scale the accomplishments of the last 20 years are anemic compared to the accomplishments of the preceding 15 years. After the national humiliation of the first Vanguard attempt, President Kennedy turned America's technical professionals loose on the seemingly impossible task of manned exploration of the moon in less than 10 years. The decade of the '60s saw a phenomenally rapid series of accomplishments leading to the Apollo 11 lunar landing in July 1969. This initial landing was followed in the next few years by a series of even more spectacular manned lunar landings and the flight of Skylab, America's first space station. These technical accomplishments were paralleled by a wealth of scientific data from both manned and unmanned explorations. The subsequent redirection of national resources away from space redistributed space program employment in the private sector, but failed to comparably trim the government support structure. Today 20 years later we have no launch system that can compare to either the payload capability or the per pound launch cost of the Saturn V developed in the 1960's. We have no "Quonset hut" operational space station like Skylab, because were are busy designing a gold plated "Taj Mahal". However we do have a billion dollar space telescope with incorrectly focused mirrors.

Rather than being a facilitator for space exploration and space science the U.S. space program is in many ways a choke point for these activities. Space program funds are allocated to big program projects, because these are the only activities that can justify the government bureaucracy and the private sector bureaucracies that support it. The political power of these expenditures in local economies insulates the system from any attempts to reform it. Therefore we continue to spend considerable resources on space with comparatively little output for our investment.

Americans love innovations that make their lives easier and more prosperous. That is why we love our Japanese cameras, TV's and cars, because they offer well engineered innovations and quality products. Our newspapers are full of soul searching articles over the apparent demise of Yankee ingenuity. However Yankee ingenuity was always motivated by Yankee profitability. The men and women who created the great technical innovations that propelled America to world leadership took great pride in the contribution they were making to America. However their primary motivation was their own prosperity.

Engineering in America is no longer a profession, but simply an entry level job. With no possibility of remuneration for technical innovation, management is the only avenue for career advancement. The result of this system is a bloated bureaucracy of technical managers attempting to obtain prosperity through people skills for which they were neither trained nor especially gifted rather than using the technical skills for which they were trained and which America so desperately needs.

Japan is a nation of engineers while America is becoming a nation of attorneys. A recent newspaper article noted that Japan has 400 engineers per 10,000 population while the United States has 70. Sixty five percent of Japanese company directors have engineering degrees while in the United States 65% have degrees in law, accounting or finance. We have no reason to blame the fine men and women who choose law, accounting or finance for a career. Americans still have the freedom to choose their careers and that choice is strongly influenced by the financial rewards they expect to receive. In every society human resources flow to the highest return. However in a free society the highest return is also the highest value as determined by a free market. There are no long term shortages in a free market. Consequently the widespread public concern over America's technical competitiveness in world markets and the dominance of U.S. patent applications by foreign inventors are irrefutable evidence of the feudalization of American technology which diverts wealth from the scientists and engineers that create technology to the power structures that control technology.

The control of American technology is based on laws which both deny American engineers a share in the inventions they create and also deny them the opportunity for self employment and the chance to independently develop new technology and new products. The attorneys who are hired to support this system for the most part do not understand technology and therefore are not in a position to contribute to the creation of new technology. However they do understand the law and how the law can be used to control existing technology and thwart the development of new technologies that might threaten the commercial positions of the companies they work for. The impressive amount of new technology that America does produce is primarily due to the efforts of companies who are small enough to remain entrepreneurial and fortunate enough to have remained independent of large company control.

America's large companies and government laboratories are vast technical collective farms where our scientists and engineers toil as serfs for the power structures. Just like in the former Soviet Union they produce output, but like all collective efforts requiring individual initiative, their output is a poor return on the resources invested. However every American who receives new product catalogues knows that innovation is not dead in America, it is simply being redirected.

America is still full of creative men and women trying to enhance their prosperity by inventing new and useful products for American society. However the laws of our land deny them any intellectual property rights in the area of their employment (which of course is also the area of their primary expertise). Therefore these resourceful Americans invent new products for the home and garden: new lawn sprinklers, new automatic pet feeders, new swimming pool toys etc. Like their counterparts in the former Soviet Union these Americans cultivate the small private plots they are allowed to till and in general produce a bountiful harvest. However the Soviet Union couldn't feed its people from private plots and American industry can't maintain world leadership on home and garden innovation. While American innovators apply their talents at the fringe of society, the core of American industry is rotting away from obsolescence. Most of the better engineers in large companies have escaped to management and many of the rest are struggling to get there.

4.9 RECOMMENDATION: ESTABLISH AN INVENTOR'S BILL OF RIGHTS - We need an inventor's bill of rights to guarantee inventors a reasonable share of the results of their creativity as an incentive for American innovation. Certainly companies who employ engineers and the U.S. Government when they fund programs deserve the lion's share of the return on new innovations. However a guaranteed return to the inventor is the crucial element needed as an incentive in the process. An example of such a plan might be as follows.

Employee inventors would be guaranteed 10% of the value added to products containing their patentable inventions. Value added would be based on the value in the market place of a comparable product without the innovation less the production cost of including the innovation. If the innovation was created under a government contract both the company and the inventor would be guaranteed 10% (for a total of 20%) for the life of the patent. In general if the work was performed under a subcontract, the contracting company or the government would receive the 80% share and the subcontracting company and inventor would each receive 10%. Invention compensation payments would be independent of the employee's normal pay and even independent of his employment.

The ability to obtain compensation for technical innovation would motivate many of America's technically creative men and women to remain in technical work. While their salaries might not compete with management, the sum of their salaries and invention compensation could provide them with a comparable total income. This would open the door for many less creative but bright and competent technical professionals to become managers. Many of these men and women have better people skills and would make better managers than their more creative coworkers.

4.10 RECOMMENDATION: REQUIRE DEVELOPMENT OR LICENSING OF NEW TECHNOLOGY - The purpose of intellectual property laws is to promote technical innovation by giving the inventor certain exclusive rights to the invention for a limited period of time. These laws were never intended to be used to give political power structures the right to suppress technology. Therefore the patent laws should be changed to require development or licensing of all patented inventions. The annual patent fees which only serve to force small inventors to sell to companies are no financial burden to a large company wishing to suppress a technology. Under this recommendation any individual or corporation could file a request for a 5% non-exclusive license to commercialize any existing patent. If the current holder of the patent was failing to make reasonable progress in commercializing the invention, the government could authorize the requested licenses. Reasonable progress would be based on both the size of the company holding the patent and the importance of the invention.

4.11 RECOMMENDATION: ESTABLISH A NARROWER DEFINITION OF PROPRIETARY INFORMATION AND TRADE SECRETS - The patent laws provide 17 years of protection for inventions made public through the patent process. However companies can choose not to file for patents and to keep the technical details of their processes proprietary. If these companies are powerful enough, they can keep these processes proprietary forever and thereby gain a perpetual patent right. A good example is soft drink formulas. In this age of detailed drug testing and DNA mapping I find it hard to believe that one could not fairly easily determine and reproduce the formulas for Coke, Pepsi and all the other soft drinks. However the burden of proof would be on the inventor to show that he did not steal the formula. Without unlimited resources the inventor would simply be crushed by the legal forces of these large companies. Society benefits from the open format of the patent process both by ensuring that new technology will pass into the public domain in 17 years and by promoting the synergistic development of technology through the public description of patented innovations. The laws protecting non-patented proprietary material should be changed to limit the period of this protection. Companies would be allowed to protect non-patented concepts or processes for a period of only five years. After five years time this material would be considered to be public domain.

4.12 RECOMMENDATION: PROMOTION OF SMALL BUSINESS OPPORTUNITIES IN ENGINEERING AND SCIENCE - One of the greatest benefits of freedom is the diffusion of power. A free market is the diffusion of economic power to the people. Democracy is the diffusion of political power to the people. We need a similar mechanism to diffuse technical power more broadly throughout American society. My recommendation is that all government contracts require that 20% of the research and engineering expenditures be subcontracted to small businesses. The government monitors of such public fund expenditures would have review and approval rights on these subcontracts to ensure the wide dispersal of technical knowledge and expertise throughout American society.

Our American Renaissance depends on maximizing the strengths of the American people. Our strength does not lie in raw numbers; other nations have far more people than we do. Our strength does not lie in organization; other nations like Japan are far more ordered and disciplined than we are. America's strength lies in the creative individualism of the American people. America is a diverse society formed by immigrants from many lands. These immigrants were risk takers willing to leave their homes to make a better life in a new land and willing to work hard to make that dream a reality. Over the last 200 years their descendants have produced a series of political, social, economic and technical innovations unprecedented in human history. These advances were fueled by the freedom of American society which both fostered motivation and encouraged ability enhancements especially innovation. The restoration of freedom from theft to American society particularly in the area of technical innovation can unleash the creative talents of the American people and propel our nation into the 21st century on the crest of an American Renaissance.

Conclusion of Section 4.4 Innovation

and

Conclusion of Chapter 4.0 FOUR TIRES OF PROSPERITY

The mechanics of MAAP administration would be through private financial institutions much like IRAs. At the end of January each taxpayer would receive both a statement of the net worth of his MAAP account and his W-2 showing both his wages and his income withholding that had been deposited in his MAAP account (initially 15.3% of his salary). Once the value of accumulated MAAP assets exceeded the minimum curve, the MAAP statement would start showing a accessible balance. This balance could be left in the MAAP account or withdrawn at the individual's discretion without any tax consequences. Individuals who left all or part of their balance intact would see their MAAP assets increase up to the second curve. When MAAP assets exceeded the second (or 10%) curve, the MAAP administrator would inform the customer's employer to only withhold 10% of salary for MAAP contributions. When the MAAP assets exceeded the third curve, withholding would drop to 5% and finally when the assets exceeded the top curve, no withholding would be required. If the assets fell below one of the asset accumulation curves either due to poor investment return or use of the assets, the appropriate withholding rate would be reinstated.

The mechanics of MAAP administration would be through private financial institutions much like IRAs. At the end of January each taxpayer would receive both a statement of the net worth of his MAAP account and his W-2 showing both his wages and his income withholding that had been deposited in his MAAP account (initially 15.3% of his salary). Once the value of accumulated MAAP assets exceeded the minimum curve, the MAAP statement would start showing a accessible balance. This balance could be left in the MAAP account or withdrawn at the individual's discretion without any tax consequences. Individuals who left all or part of their balance intact would see their MAAP assets increase up to the second curve. When MAAP assets exceeded the second (or 10%) curve, the MAAP administrator would inform the customer's employer to only withhold 10% of salary for MAAP contributions. When the MAAP assets exceeded the third curve, withholding would drop to 5% and finally when the assets exceeded the top curve, no withholding would be required. If the assets fell below one of the asset accumulation curves either due to poor investment return or use of the assets, the appropriate withholding rate would be reinstated.